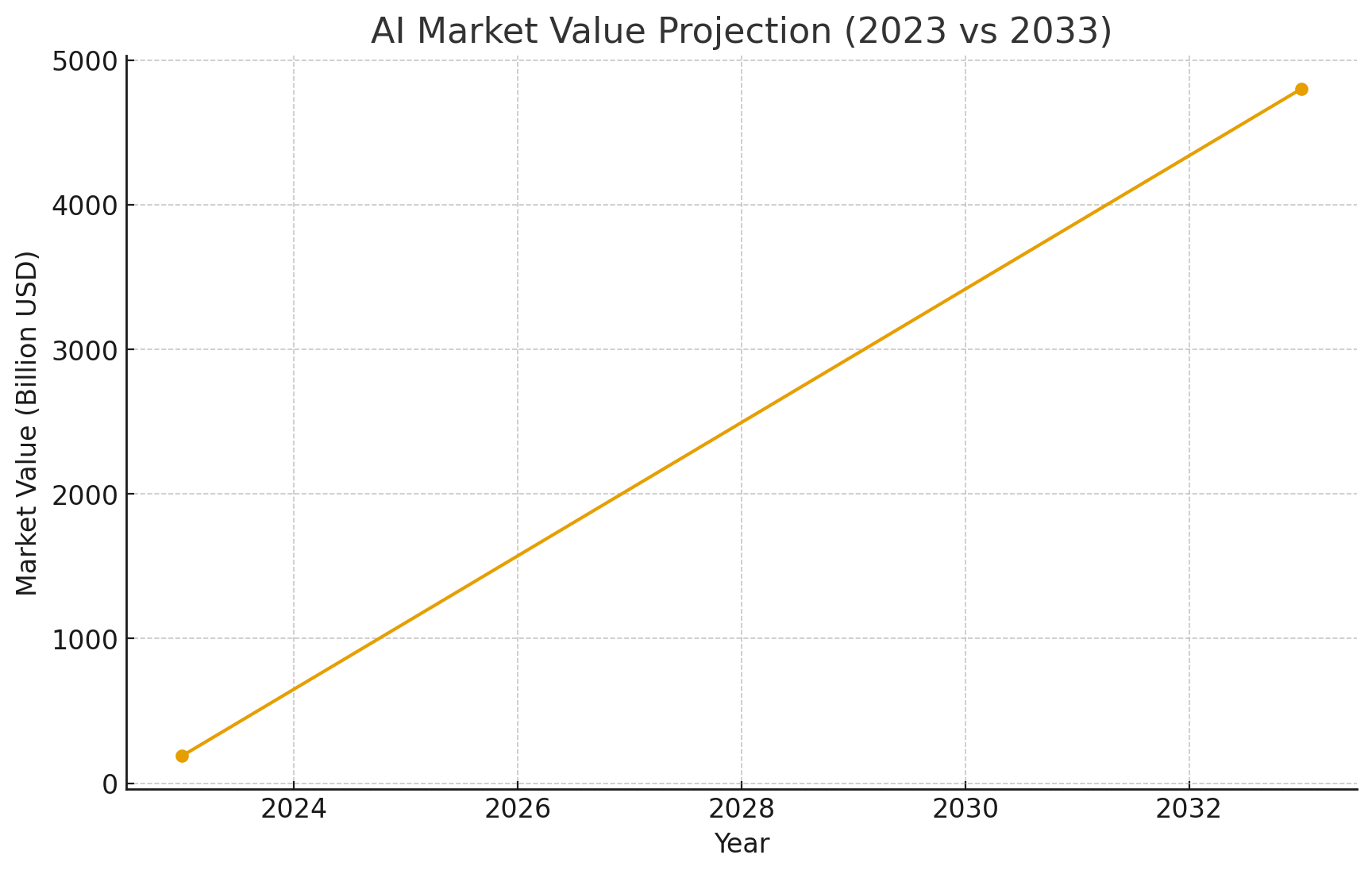

Experts say the AI market is set to explode. Valued at $189 billion in 2023, it’s projected to increase 25-fold in just a decade, hitting $4.8 trillion by 2033.

Many enterprises already recognize the importance of integrating AI into workflows, especially with the new wave of agentic initiatives. But it's hard to separate hype from reality and determine where organizations are truly benefitting the most.

McKinsey’s latest global survey aims to accurately assess the state of AI, capturing the thoughts of 1,993 participants across various countries, industries and company sizes. Here are the biggest takeaways:

Table of Contents

- 1. Widespread AI Use, But Limited Scaling

- 2. The Rise and Early Exploration of AI Agents

- 3. Enterprise Value Lagging Qualitative Benefits

- 4. Defining Characteristics of High-Performing Organizations

- 5. Workforce Impact and Mitigating Risks

1. Widespread AI Use, But Limited Scaling

AI adoption is nearly universal, but most organizations have yet to integrate it deeply enough to capture material enterprise-level benefits.

High Adoption Rate: Nearly 9 out of 10 respondents said their organizations regularly use AI, and 88% report regular AI use in at least one business function (compared to 78% a year ago).

Stuck in Early Stages: The majority of orgs are still stuck in the experimentation or pilot phases. Nearly two-thirds of those polled report their organizations have not yet started scaling AI across the enterprise.

Scaling is Size-Dependent: Larger companies — those with more than $5 billion in revenue — are more likely to reach the scaling phase compared to smaller companies.

Broadening Application: Organizations are increasingly using AI across multiple functions. More than 66% of those surveyed now use AI in more than one function, and half say they use AI in three or more functions. Business functions with the most reported AI use include: IT, marketing and sales.

2. The Rise and Early Exploration of AI Agents

AI agents — systems capable of planning and executing multiple steps in a workflow based on foundation models — are drawing significant interest, though actual large-scale deployment is nascent.

High Interest in Agents: 62% of respondents said their organizations are at least experimenting with AI agents.

Early Scaling: 23% of those surveyed report that their organizations are scaling an agentic AI system somewhere in their enterprises.

Limited Scope: The use of agents is not yet widespread across the entire enterprise landscape. Most organizations scaling agents are only doing so in one or two business functions.

Leading Areas: AI agent use is most widely reported in the technology, media and telecommunications and healthcare sectors. Functionally, agent use is most common in IT (e.g., service-desk management) and knowledge management (e.g., deep research).

Related Article: Why AI Pilots Miss the Mark — and What the Top 5% Get Right

3. Enterprise Value Lagging Qualitative Benefits

While AI is netting positive results at the use-case level, the benefits have not broadly translated into significant enterprise-wide financial impact. In fact, reports show only 5% of companies are seeing any real return on investment from AI.

Limited EBIT Impact: Only 39% of those polled attribute any level of EBIT (Earnings Before Interest and Taxes) impact to AI, and for most, this impact is less than 5%.

Qualitative Benefits Are Strong: A large majority of respondents (64%) say AI is enabling innovation. Other commonly cited benefits include: improvements in customer satisfaction and competitive differentiation.

Cost and Revenue Drivers:

- Cost benefits are most commonly reported in software engineering, manufacturing and IT.

- Revenue benefits are most commonly reported in marketing and sales, strategy and corporate finance and product and service development.

4. Defining Characteristics of High-Performing Organizations

The small group of "AI high performers" (those attributing 5% or more of EBIT impact to AI) share a set of ambitious strategies and practices that differentiate them from their peers.

Bold Ambition: High performers are 3x more likely than others to say their organization intends to use AI to bring about transformative change to their businesses.

Focus on Growth and Innovation: While most companies focus on efficiency (cost reduction) as an AI objective, high performers often set growth and/or innovation as additional objectives. Organizations that use AI to spur innovation and growth are more likely to achieve a range of qualitative enterprise-level benefits.

Strong Leadership Commitment: High performers are 3x more likely to strongly agree that their senior leaders demonstrate ownership of and commitment to their AI initiatives, including role modeling the use of AI.

Strategic Investment: Over one-third of high performers commit more than 20% of their digital budgets to AI technologies, significantly higher than other organizations.

Related Article: The Real Mistake of GenAI — and What Comes Next

5. Workforce Impact and Mitigating Risks

Perspectives on AI's impact on employment vary, and organizations are becoming more proactive in managing AI risks.

Differing Employment Expectations: Workforce expectations are mixed for the year ahead:

- 43% expect little or no change in workforce size

- 32% expect a reduction of 3% or more

- 13% predict an increase

Demand for Talent: Organizations, especially larger ones, have hired for AI job roles over the past year, with software engineers and data engineers being the most in demand.

Increased Risk Mitigation: Organizations are increasing their efforts to mitigate AI-related risks, managing an average of four risks today, up from two in 2022. Inaccuracy is the AI-related risk that nearly one-third of respondents report experiencing consequences from — and is one of the most commonly mitigated risks.

High Performers and Risk: High performers, due to their ambitious use of AI in mission-critical contexts, are more likely to report negative consequences (related to intellectual property infringement and regulatory compliance, for example) but also report mitigating these risks at a higher rate than others.