On September 8, 2025, Databricks officially broke through a $4 billion annualized revenue run-rate, achieving a remarkable over 50% year-over-year growth in Q2. Notably, AI-driven products alone contribute more than $1 billion to this run-rate.

The firm is also finalizing its Series K financing — a $1 billion raise placing Databricks’ valuation north of $100 billion. This funding round is co-led by prominent backers, including Andreessen Horowitz, Insight Partners, MGX, Thrive Capital and WCM Investment Management.

Databricks has more than 650 enterprise clients generating more than $1 million in annual revenue each. The company's net revenue retention remains robust — over 140% — and it has maintained positive free cash flow throughout the past year.

Databricks Doubles Down on AI With Agent Bricks and Lakebase

According to company officials, Databricks plans to deploy the fresh capital to expand its AI strategy. Key initiatives include:

- Scaling Agent Bricks: AI agents optimized on enterprise data

- Introducing Lakebase: a new category of operational, OLTP-style database tailored to AI agents

The capital infusion will also support global expansion, further AI R&D and potential acquisitions.

"With this new capital, we can move even faster with Agent Bricks, helping customers in every industry turn their data into production AI agents, and carry more momentum as we create the new Lakebase category, reinventing databases for AI agents."

- Ali Ghodsi

Co-Founder and CEO, Databricks

Recent strategic collaborations with tech giants like Microsoft, Google Cloud, Anthropic, SAP and Palantir, alongside real estate expansions in San Francisco and Sunnyvale, could position the company to deepen enterprise adoption and secure top AI talent as competition for both intensifies.

Databricks has also focused on other ecosystem partnerships, including its integration with Alteryx and a major expansion with Confluent for real-time AI capabilities announced in February 2025.

Related Article: The Hidden Infrastructure Costs of Enterprise AI Adoption

Why Investors Are Betting on AI Platforms

Databricks’ surge aligns with a broader boom in AI-powered enterprise tools: global M&A in data infrastructure surged in early 2025, accounting for 25% of the $1.67 trillion total despite geopolitical headwinds.

Companies like Meta, Salesforce, and IBM are aggressively acquiring data-centric tech to underpin AI capabilities. Analysts note that “quality and organization of data are essential to avoid AI errors.”

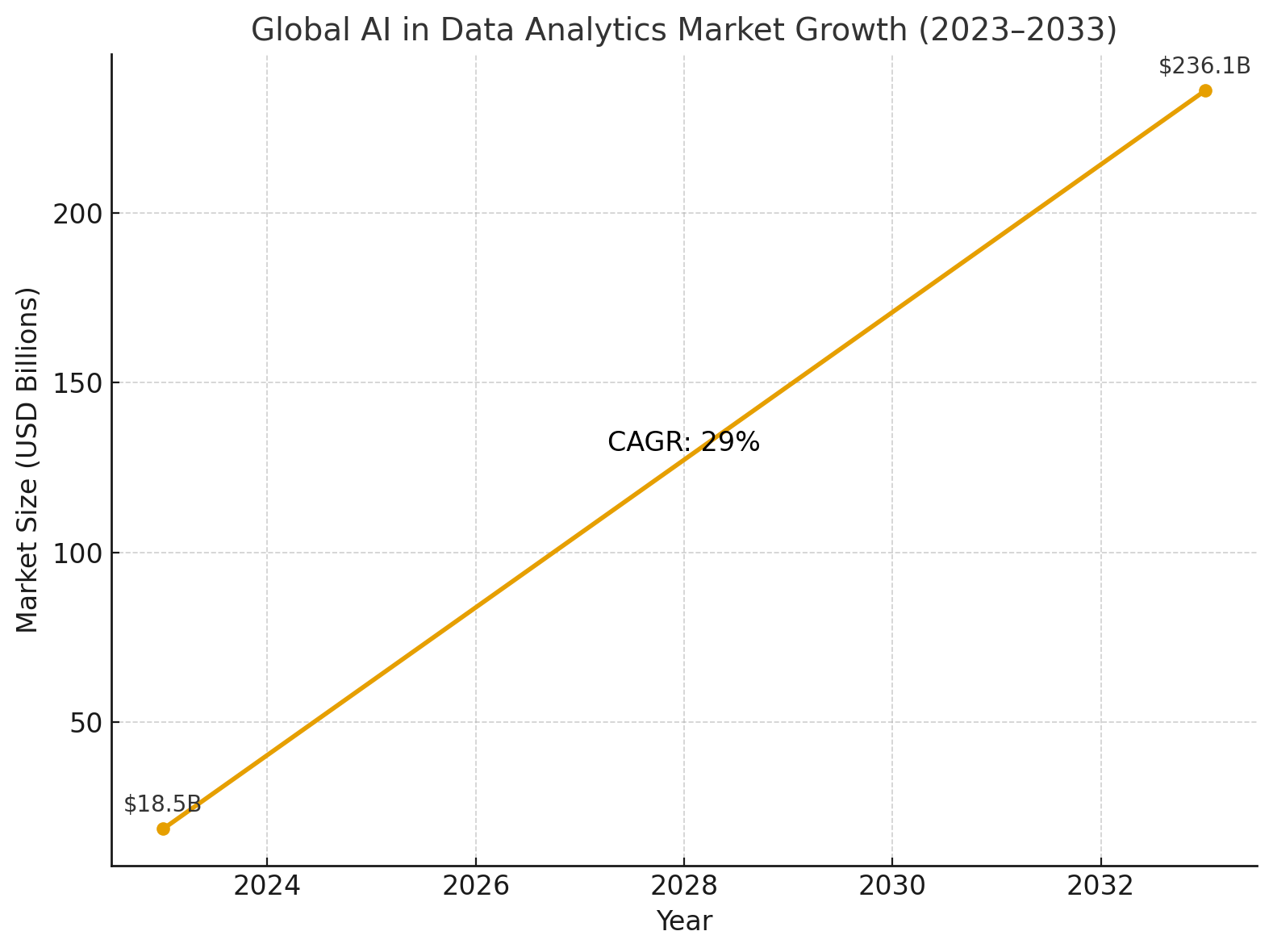

At the same time, the global AI in data analytics market is forecast to skyrocket, expected to grow from roughly $18.5 billion in 2023 to $236.1 billion by 2033, a CAGR of about 29%. Meanwhile, the broader AI data management sector is projected to climb from $25.52 billion in 2023 to $104.32 billion by 2030, at a 22.3% CAGR.

The demand for unified data and AI platforms, especially those supporting predictive analytics, AI governance and operational AI workloads, is fueling interest in Databricks’ Lakehouse architecture. Its competitive positioning is strong: while rivals like Snowflake sit near similar ARR levels, Databricks’ growth is notably faster — roughly double — and its AI capabilities give it an edge.

Enterprise AI’s Next Chapter: Why Databricks Is at the Center

- High-growth leadership: Databricks is outperforming many peers with more than 50% annual growth and AI revenues crossing $1 billion.

- Investor confidence: A blockbuster $1 billion funding round and over $100 billion valuation reflects serious market belief in Databricks' vision.

- Strategic innovation: Products like Agent Bricks and Lakebase mark a shift toward AI-native infrastructure, poised to power enterprise-scale automation.

- Macroeconomic tailwinds: With AI & data infrastructure investments surging, Databricks is riding the wave of demand for intelligent, scalable data platforms.