Key Takeaways

- IBM plans to acquire Confluent for $11 billion in cash.

- The deal aims to bolster IBM's AI and cloud data capabilities.

- Large enterprise clients may see enhanced data integration for AI workloads.

IBM is betting $11 billion that real-time data streaming will become the backbone of enterprise AI infrastructure.

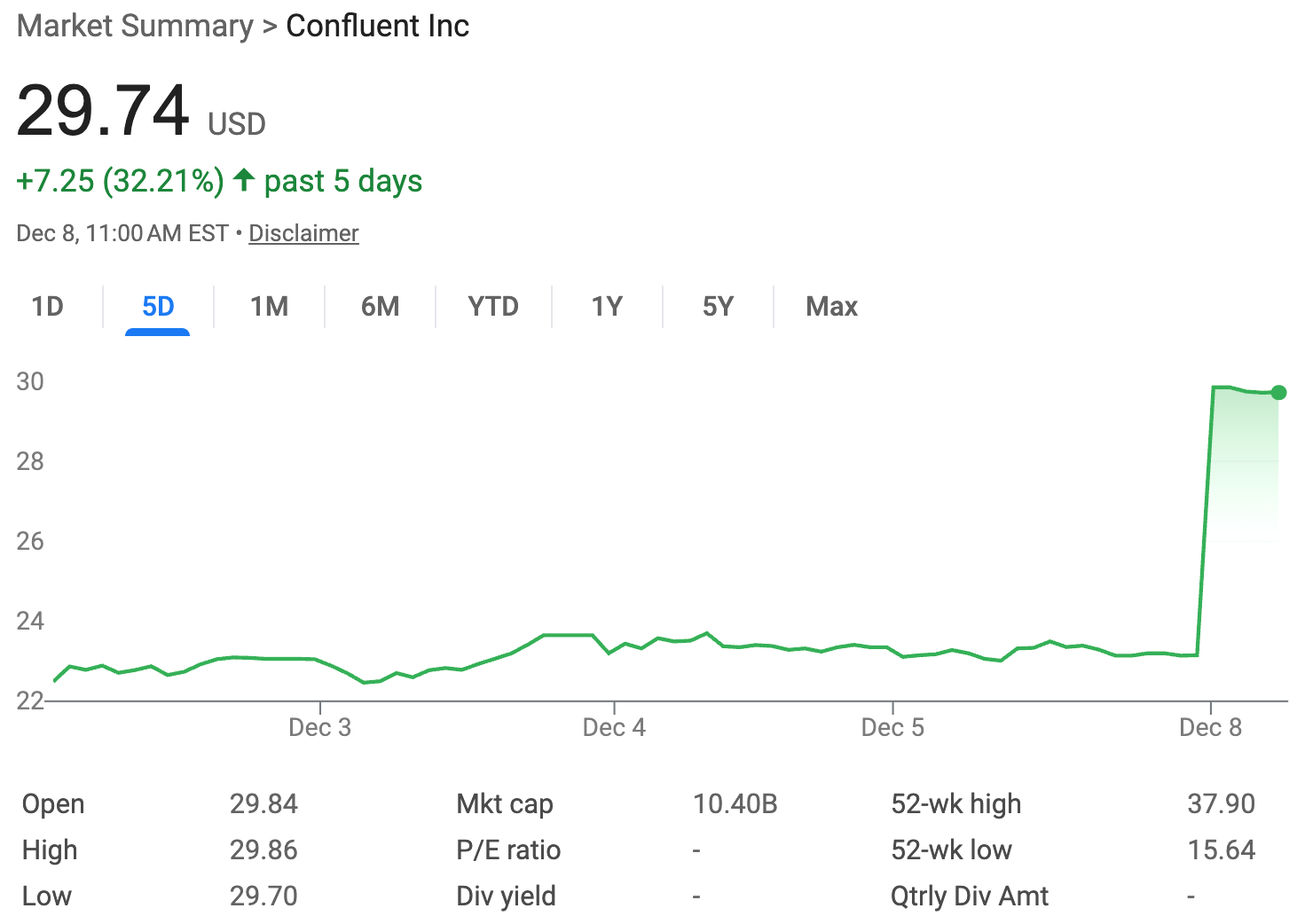

The company announced December 8 that it will acquire data streaming platform Confluent in an all-cash deal, sending Confluent shares up 29% while IBM stock gained about 1%. According to company officials, IBM will pay $31 per share for all outstanding Confluent common shares, a significant premium over Confluent's Friday closing price of $23.14. The deal is expected to close by mid-2026.

Table of Contents

- IBM Recent News & Initiatives

- Enterprise Data Streaming: Key Trends Shaping AI-Ready Infrastructure

- Strategic Rationale & Market Impact

- IBM Background

IBM Recent News & Initiatives

IBM is aggressively expanding its enterprise AI capabilities through acquisitions, model development and strategic partnerships.

DataStax Acquisition

In February 2025, IBM announced plans to acquire DataStax, a move the company said would deepen watsonx capabilities and address generative AI data needs for enterprises.

Granite 3.2 Model Family Expansion

IBM expanded its Granite model family with Granite 3.2 in February 2025, introducing multi-modal and reasoning AI capabilities built for enterprise use.

- Programmable chain-of-thought reasoning that toggles on or off to reduce compute overhead

- Vision and guardrail models for enhanced functionality

- TinyTimeMixers models with sub-10M parameters capable of forecasting up to two years ahead

Strategic Collaborations

Penn State Partnership

In February 2025, Penn State selected IBM to develop an AI virtual assistant designed to foster student success across its multi-campus system.

Lumen Technologies Alliance

IBM and Lumen Technologies announced a collaboration in May 2025 focused on scalable AI at the edge, targeting manufacturing, retail, logistics and financial services.

Enterprise Data Streaming: Key Trends Shaping AI-Ready Infrastructure

AI readiness, hybrid cloud demands and persistent data silos are accelerating enterprise adoption of data streaming and real-time integration.

Research found only 22% of companies are "future ready" with data infrastructure, while 51% remain stuck with disconnected systems and incompatible technologies.

Hybrid Cloud Strategies Reshape Data Architecture

An overwhelming 90% of IT decision-makers plan to rethink cloud strategies to balance cost, control and AI workload performance. Organizations increasingly favor hybrid environments driven by data security (50%), integration with existing systems (48%) and cost savings (44%).

Breaking Down Data Silos for AI Success

The link between data maturity and AI adoption is stark. While 55% of organizations have rolled out 100 or more AI use cases over the past year, only 19% can demonstrate AI's value in driving business goals. This gap often traces back to data quality issues, silos and infrastructure shortfalls.

Strategic Rationale & Market Impact

"With the acquisition of Confluent, IBM will provide the smart data platform for enterprise IT, purpose-built for AI."

- Arvind Krishna

CEO, IBM

IBM executives claim the acquisition will strengthen the company's AI portfolio as global data growth is expected to more than double by 2028. The deal aims to add data processing capabilities to IBM's hybrid cloud ecosystem and help eliminate data silos for powering AI applications.

| Added Capability | What It Enables |

|---|---|

| Data Streaming Platform | Real-time data processing across enterprise systems |

| Client Base | Over 6,500 clients across major industries |

| Partner Ecosystem | Integrations with Anthropic, AWS, Google Cloud, Microsoft, Snowflake |

| AI Infrastructure | Platform purpose-built for enterprise AI workloads |

IBM Background

The acquisition continues IBM's aggressive M&A strategy in cloud and AI infrastructure. The company previously acquired HashiCorp for $6.4 billion in 2024 and Apptio for $4.6 billion in 2023, both in all-cash deals. Wedbush analysts maintained their overweight rating on IBM with a $325 price target, calling it a "strong move" that takes IBM "further into the AI Revolution."