The Gist

-

AI in marketing. AI is changing customer acquisition in financial services by optimizing targeting, personalization and media buying to reduce costs and increase engagement.

-

Predictive AI models. AI-powered predictive analytics improve decision-making in credit scoring, loan underwriting and customer engagement.

-

Data-driven AI. Access to diverse data sets enables more accurate AI predictions and personalization, which enhances CX and drives ROI in financial services.

The financial services industry has made significant investments in AI, with $35 billion allocated to AI initiatives in 2023, $21 billion of which came from the banking sector alone. For early adopters, these investments have already proven worthwhile. Seventy-seven percent of institutions with AI use cases report ROI on at least one initiative, and 90% of companies running generative AI in production reported revenue gains of 6% or more. According to JPMorgan CEO Jaime Dimon, "AI has the potential to augment virtually every job at our company and transform our operations."

The ability of AI in financial services to enhance both revenue and operational efficiency makes it a high-ROI investment for customer acquisition, where AI is transforming how organizations identify, attract and engage clients. Early gains are encouraging and can make a meaningful impact on conversion rates and sales revenue.

Here are some ways in which AI is transforming customer acquisition across each stage of the funnel with a focus on specific use cases and quantifiable results.

Table of Contents

- Key Drivers of AI Value

- Using AI in Financial Services to Maximize Customer Acquisition

- Top Funnel: AI-Driven Strategies for Building Awareness

- Middle Funnel: Engaging and Nurturing Leads

- Bottom Funnel: Driving Purchases with AI in Financial Services

- How Data Powers AI-Driven Customer Acquisition

- AI’s Long-Term Impact on Financial Services

Key Drivers of AI Value

To help frame our example use cases, it’s helpful to classify the different ways effective AI solutions generate value for organizations in most industries.

AI Value Drivers

-

Operational efficiency and scalability

-

Real-time experience personalization

-

Enhanced decision-making and risk management

-

Enhanced innovation

More than just a label, drivers help align AI solutions with organizational goals and focus efforts on meaningful outcomes. Many companies just starting out with AI find best results when they focus on optimizing a single value driver and use that as a platform for future enhancements. For example, while AI-enabled content generation could provide both operational efficiency and personalization, focusing on operational efficiency first will free the team up to be more successful at personalization at a later stage.

Related Article: How Customer Service in Financial Services Drives Loyalty

Using AI in Financial Services to Maximize Customer Acquisition

Customer acquisition is a first stop for companies looking to use AI in financial services to increase revenue and meet growth targets, with marketers leading the way. A look at the results from MartechTribe’s survey of top generative AI-based tools in marketing helps identify early successes in content generation, sales automation, business intelligence, chatbots and video marketing. Its core use cases are emerging in the stages of the acquisition funnel. But what solutions are most prevalent with today’s financial services companies?

Top Funnel: AI-Driven Strategies for Building Awareness

Content Generation and Personalization

By far the most adopted use case for AI in marketing is reducing time and effort in content generation. For each segment or personalization feature, custom content may be required, which exponentially increases the workload for the creative team. Marketing teams routinely use AI to generate briefs, storyboards, copy, images, videos and voiceovers.

AI-Enhanced Media Buying and Ad Targeting

AI-driven media buying and targeted advertising are reshaping the way financial services organizations approach prospecting. AI models analyze vast data sets to identify high-value customer segments, and they optimize marketing spend by delivering the right message to the right audience. Klarna, for example, leveraged AI to optimize its ad placements, resulting in a $10 million reduction in marketing costs.

Predictive Analytics

By analyzing historical behavior, demographics and transactional data, AI allows companies to refine their targeting efforts, which leads to deeper engagement and improved conversion rates. In fact, predictive analytics in marketing can improve engagement metrics by up to 20%.

Middle Funnel: Engaging and Nurturing Leads

Scoring and Assessment

AI-powered models can analyze a broader set of factors, including non-traditional data, to evaluate creditworthiness and speed credit scoring and approval. They’re effective at expanding markets, generating higher approval rates, lowering default risks and reaching underserved audiences.

Loan Underwriting and Application Process

AI in financial services streamlines this traditionally labor-intensive process, speeds up decision-making and increases processing capacity by 30%.

Chatbots and Conversational AI

Conversational assistants streamline customer interactions during the application process. Tools like Bank of America’s Erica can handle routine inquiries, guide customers through applications and provide quick responses.

Bottom Funnel: Driving Purchases with AI in Financial Services

Cross and Up Sell

By analyzing each customer’s transaction history and behaviors, AI models can predict and recommend products and services most relevant to their needs. Financial institutions implementing AI-driven cross-sell strategies have reported an average revenue increase of 15% per customer.

Personalized Recommendations

In wealth management, AI is allowing financial advisors to provide highly tailored investment recommendations and build loyalty. By analyzing clients’ goals, risk tolerance and market conditions, AI-driven systems can generate personalized advice that aligns with each client’s unique situation, and AI personalization tools are projected to increase client engagement by up to 25%.

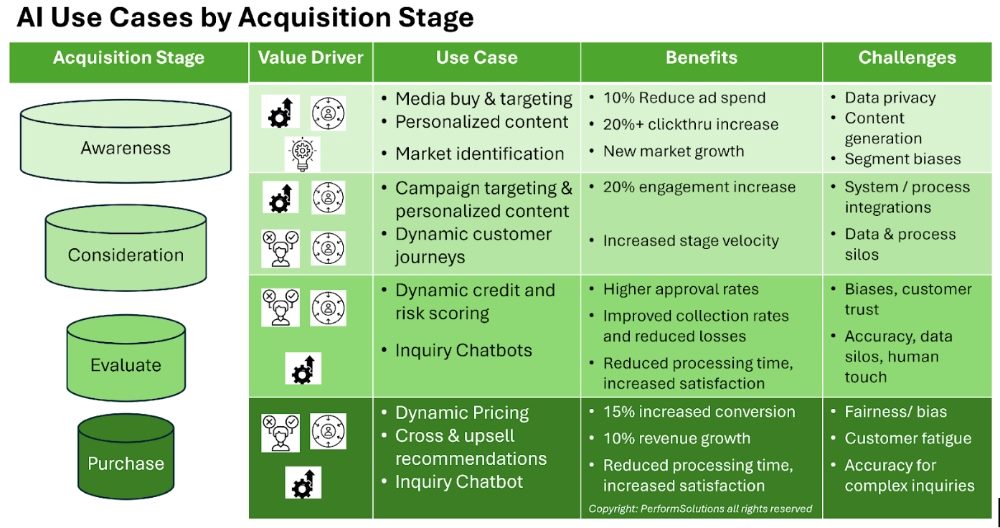

This chart illustrates the different value drivers and use cases in play in each stage of the acquisition funnel.

How Data Powers AI-Driven Customer Acquisition

One of the most interesting insights I’ve gained from clients implementing AI solutions is the improved prediction accuracy and usefulness as models gain access to a broader and more diverse set of data. Such an endeavor requires partnership with the data engineering team to normalize unstructured and structured data into common formats and locations (i.e., data warehouses, lakes and lakehouses).

This can be harder than it sounds, as one insurance client found when trying to develop attribution models, target whitespace audiences and implement personalization tactics. Because the data from webforms, email and phone-based acquisition channels were in different locations and formats, they were unable to reveal attribution, generate new audiences and deliver personalized content. As Ryan Swann, chief data analytics officer at Vanguard, said, “At Vanguard, data, analytics and AI are more than strategic assets. It's about synthesizing data to extract business value."

Related Article: Customer Data Analytics and AI: The Smart Path

AI’s Long-Term Impact on Financial Services

AI is increasingly a critical enabler of customer acquisition in financial services. From optimizing prospect targeting to enhancing customer retention, AI has demonstrated its value across every stage of the acquisition funnel. With industry investments climbing and ROI becoming tangible, AI is poised to be a core growth driver for financial institutions that embrace it strategically.

For financial services executives, now is the time to assess and invest in AI to stay competitive. Get started by exploring your existing platforms and determine what AI elements can be initiated quickly.

The earlier you start navigating the data, governance and optimization components, the sooner you can capitalize on AI’s transformative potential in customer acquisition and throughout the entire organization.

Learn how you can join our contributor community.