The Gist

- Intensifying scrutiny. The UK’s CMA launches a new probe into Google’s dominance in search and advertising amidst growing AI integration.

- Potential changes ahead. The investigation may compel Google to provide access to AI data and ensure fair competition for publishers and businesses.

- Impact on discoverability. The focus on AI search disruption highlights the need for transparency and competition in content discoverability strategies.

Google faces a new probe by the UK's Competition and Markets Authority (CMA) that could give marketers and brands access to data secrets behind Google's AI services.

The CMA's investigation into Google’s position in search comes as regulators intensify scrutiny over its dominant position in search and search advertising and aims to assess how Google's practices affect consumers, businesses, advertisers and competitors in an era where AI increasingly shapes content discovery.

It's also another Google antitrust case, as we call it in the States. Google's already in the midst of similar antitrust cases in the US. Most notably, a U.S. federal judge in a historic decision in August ruled that "Google is a monopolist, and it has acted as one to maintain its monopoly."

But about those AI secrets: One of the biggest takeaways for UK publishers and brands watching the content discoverability clash of SEO, Web and AI Search: Google could be forced to open some secret doors behind its AI services. The CMA could compel Google to make the data it collects available to other businesses or give publishers more control over how their data is used. This includes in Google’s AI services.

Wouldn't we all like to know what Google's seeing with AI Overviews, for instance. What's the Google Analytics 4-like tool available for landing in AI Overviews or perhaps ChatGPT Search? That kind of data is precious, no?

Table of Contents

- How the CMA's Going After Google Search

- CMA Could Give Publishers Access to Google AI Data

- Google Welcomes Investigation Into Search Business

- CMA: Search Competition Is Critical

- Breaking Down CMA's Investigation Into Google Search

- The Future of Search: AI's Impact on Content Discoverability

- Core Questions Around CMA’s Probe Into Google

How the CMA's Going After Google Search

What's behind this probe?

The UK's CMA is investigating whether Google holds a Strategic Market Status (SMS) in the UK search and search advertising sectors, assessing potential weak competition, barriers to innovation and exploitative conduct. This investigation aims to determine if conduct requirements or pro-competition interventions are necessary to protect UK consumers and businesses from anti-competitive practices and promote open markets.

If CMA finds Google to hold an SMA, it can impose conduct requirements or propose pro-competition interventions to achieve positive outcomes for UK consumers and businesses — such as an AI data transparency mandate.

Does Google Search's dominance lead to any of these factors? This is what the CMA's investigation will aim to determine:

- Weak competition and barriers to entry and innovation: The CMA will evaluate how competition functions and whether Google's dominance is stifling innovation by others. This includes examining if barriers prevent new entrants, particularly in developing new AI services (e.g. ChatGPT Search) and interfaces like "answer engines" that could challenge Google Search.

- Possible leveraging of market power and ensuring open markets: The investigation will consider if Google exploits its market position to favor its own services, such as specialized search services for shopping and travel, potentially harming competitors and market openness.

- Potential exploitative conduct: The CMA will scrutinize Google’s practices around collecting and using extensive consumer data without proper consent, and the fairness of terms and conditions for using publisher content, including payment issues.

The CMA will engage a wide range of stakeholders, including advertising firms, news publishers and user groups, and gather evidence from Google before reaching a decision by October.

This isn't the first time CMA is closely watching Google. Google last April delayed third-party cookie deprecation on Chrome until early in 2025. Google said then it needed to give the UK’s Competition and Markets Authority "sufficient time to review all evidence including results from industry tests."

Google and the CMA regularly release quarterly updates on the progress of the cookie phase-out initiative, part of the Privacy Sandbox for the Web, a Google-led initiative that aims to reduce cross-site and cross-app tracking while helping to keep online content and services free.

Related Article: Cookies to Courtrooms: Google's Antitrust Trials and the Future of CX

CMA Could Give Publishers Access to Google AI Data

Back to today's CMA news.

Potential conduct requirements as a result of this latest Google investigation could include requirements on Google to make the data it collects available to other businesses or giving publishers more control over how their data is used, including in Google’s AI services.

This would likely leave marketers a happy bunch. Ever-hungry to learn more about the dynamics of content discoverability and AI Search, access to data on Google's AI Services could open the door for how to land in Google's AI Overviews — the new coveted landing spot on Page 1 of Google search results.

AI startups could benefit, too. CMA stressed those up-and-comers need to be able to fairly compete with the Google Machine.

Don't get too excited about the Google AI data dump yet. That would only happen after the CMA's investigation.

Related Article: AI Overviews, SGE and SEO: Differences, Challenges and the Path Forward

Google Welcomes Investigation Into Search Business

Google, meanwhile, is already embracing the process.

Oliver Bethell, director of competition for Google, wrote in a blog post today that Google looks forward to "engaging constructively and laying out how our services benefit UK consumers and also businesses, as well as the trade-offs inherent in any new regulations. People across the UK trust Google Search to help them find what they need. Search also helps millions of British businesses to grow and reach customers in innovative ways."

Google’s products, including Search, helped to provide an estimated $148 billion in economic activity in 2023 in the UK, supporting over a million businesses across the country, according to Bethell. Google Search and Ads are also helping UK businesses to export over $25 billion worth of goods and services across the world, he added.

"We welcome the recognition of the importance of digital technologies to power growth, and the need to align regulatory decisions with the Government’s growth mission," Bethell added. "A pro-innovation, evidence-based regime will help UK consumers and businesses by expanding options, reducing prices and opening new markets. The alternative of overly prescriptive digital competition rules would end up stifling choice and opportunity for consumers and businesses. We will do our best to advocate for new rules that benefit every business and let people in the UK benefit from helpful, cutting-edge services."

CMA: Search Competition Is Critical

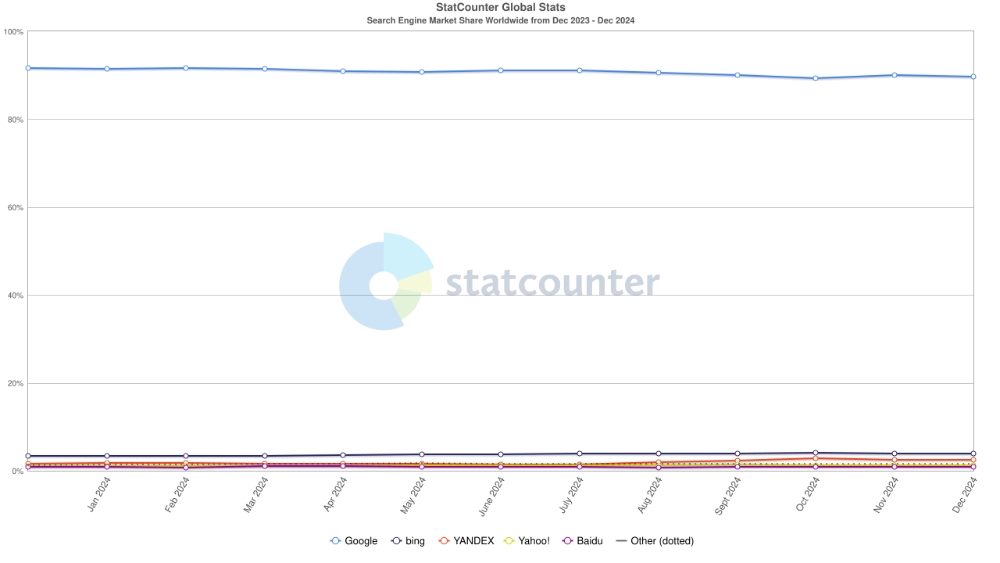

In the UK, Google accounts for more than 90% of all general search queries, and more than 200,000 UK advertisers use Google’s search advertising, according to the CMA. Worldwide, Google's at 89.74%, which some reports say is the first time since 2015 the search giant's gone under 90%.

"Search is vital for economic growth," CMA officials wrote today. "It facilitates businesses connecting with each other, with investors, and with their customers. And it generates a wealth of data that can be used to develop new AI products and services to foster innovation. Given the importance of search as a key digital service for people, businesses and the economy, it is critical that competition works well."

Sarah Cardell, chief executive of the CMA, said Google's search services need to deliver good outcomes for people and businesses, supporting a "level playing field, especially as AI has the potential to transform search services."

"It’s our job to ensure people get the full benefit of choice and innovation in search services and get a fair deal," Cardell added. "For example in how their data is collected and stored. And for businesses, whether you are a rival search engine, an advertiser or a news organization, we want to ensure there is a level playing field for all businesses, large and small, to succeed."

Breaking Down CMA's Investigation Into Google Search

Here's a summary of the SMS investigation into Google's general search and search advertising services:

- Case overview: The Competition and Markets Authority (CMA) is conducting an investigation to determine if Google should be designated with Strategic Market Status (SMS) concerning its general search and search advertising services.

- Authority: The investigation is carried out under Part 1 of the Digital Markets, Competition and Consumers (DMCC) Act of 2024.

Key 2025 Dates Around the CMA's Investigation Into Google

- Jan. 14: Official commencement of the SMS investigation, publication of the Investigation Notice, and the press release.

- Jan. 14: An Invitation to Comment was published, initiating a consultation process.

- Feb. 3: Deadline for submitting responses to the Invitation to Comment.

- February to March: Initial evidence gathering and ongoing engagement with Google and other stakeholders.

- April to June: Further evidence gathering and analysis, including a put-back process with Google on potentially confidential materials.

- July: Consultation on the proposed decision on SMS designation closes, and Google is given an opportunity to make oral representations.

- September: Possible further put-back process if necessary.

- Oct. 13: Statutory deadline for the issuance of the SMS Decision Notice.

The Future of Search: AI's Impact on Content Discoverability

We've been talking in-depth about the future of search and content discoverability because of the infusion of AI. In a November episode of The Digital Experience Show on AI search disruption, Luis Fernandez, executive director at VML Enterprise Solutions, discussed the role of generative AI in SEO and content discovery, introducing AI Visibility Optimization (AIVO) as a pivotal strategy that deviates from traditional SEO by focusing on relevance to AI bots rather than conventional search engine rankings.

Content discoverability in an AI-driven world means the emphasis shifts from optimizing for search engine algorithms to catering to the preferences and functionalities of AI bots. Fernandez elucidates how AIVO will necessitate a different approach, where content needs to be crafted to engage with AI's unique content interpretation and delivery methods, which could differ significantly from the established norms of SEO.

"AIVO ... is a completely different concept," Fernandez said. "It’s not about being highly ranked in search engines; it’s about being relevant to AI bots. These bots will have different 'personalities,' if you will—different synthetic emotions and ways of processing information. For governance, this will be a huge shift. If your content isn’t included in a bot’s conclusions or synthesized by it, you’ll be out of the game. People may still use search engines, but they’ll increasingly trust what AI bots provide."

Core Questions Around CMA’s Probe Into Google

Editor's note: Two key questions emerge as the CMA investigates Google's dominance in search and advertising services.

What is the significance of the CMA’s investigation into Google Search?

The CMA aims to determine whether Google’s dominance in search and advertising harms competition, innovation and consumer choice in the UK market. This includes examining Google's potential Strategic Market Status and assessing whether regulatory interventions are necessary to promote fairness and innovation.

How could the CMA’s findings impact publishers and advertisers?

If the CMA imposes conduct requirements, publishers and advertisers may gain access to Google’s AI data and enhanced control over their content use. This could level the playing field, improve transparency and create opportunities for smaller businesses and AI startups to compete effectively.