Faced with the increased infrastructure costs required to support AI data centers, states are passing laws to protect consumers from having to pay for them.

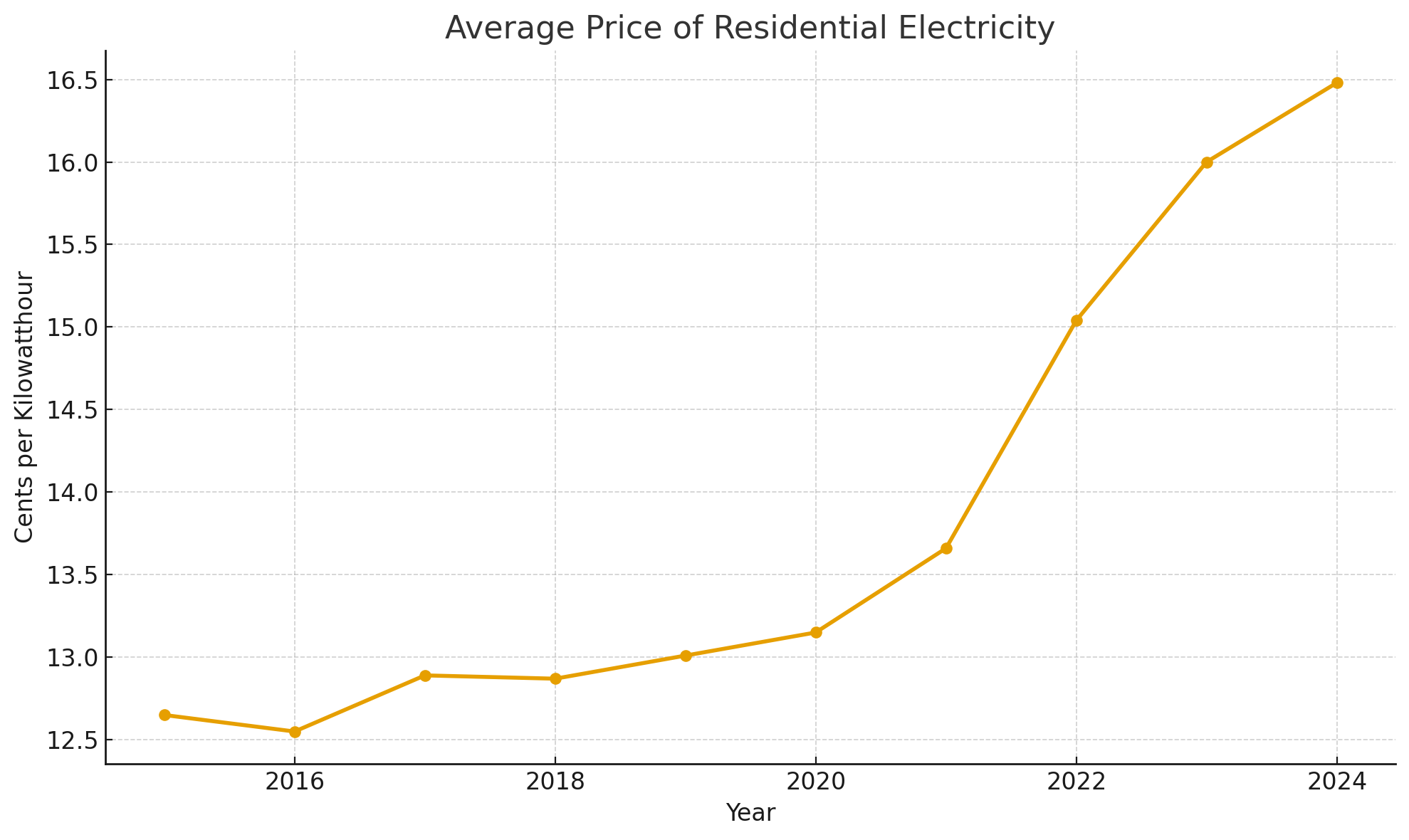

Electricity costs in the US are going up. In 2021, the average price for residential electricity was 13.66¢ per kilowatthour. By 2024, that number rose to 16.48¢. In 2025 (so far), the average cost sits at 17.10¢. These price increases are caused by a number of factors, with one being the data centers that power artificial intelligence.

Table of Contents

- Data Centers Are Driving Up Your Power Bill

- Consumers Have Already Paid Billions — With More to Come

- Confidential Contracts Keep Consumers (and Regulators) in the Dark

- Will Utility Companies Fight Back — or Fuel the Fire?

- When the Bill Is Due Before the Lights Are On

- Some States Push Back Against AI Power Costs

- Federal Oversight May Be the Missing Link

Data Centers Are Driving Up Your Power Bill

Let's take a deeper dive.

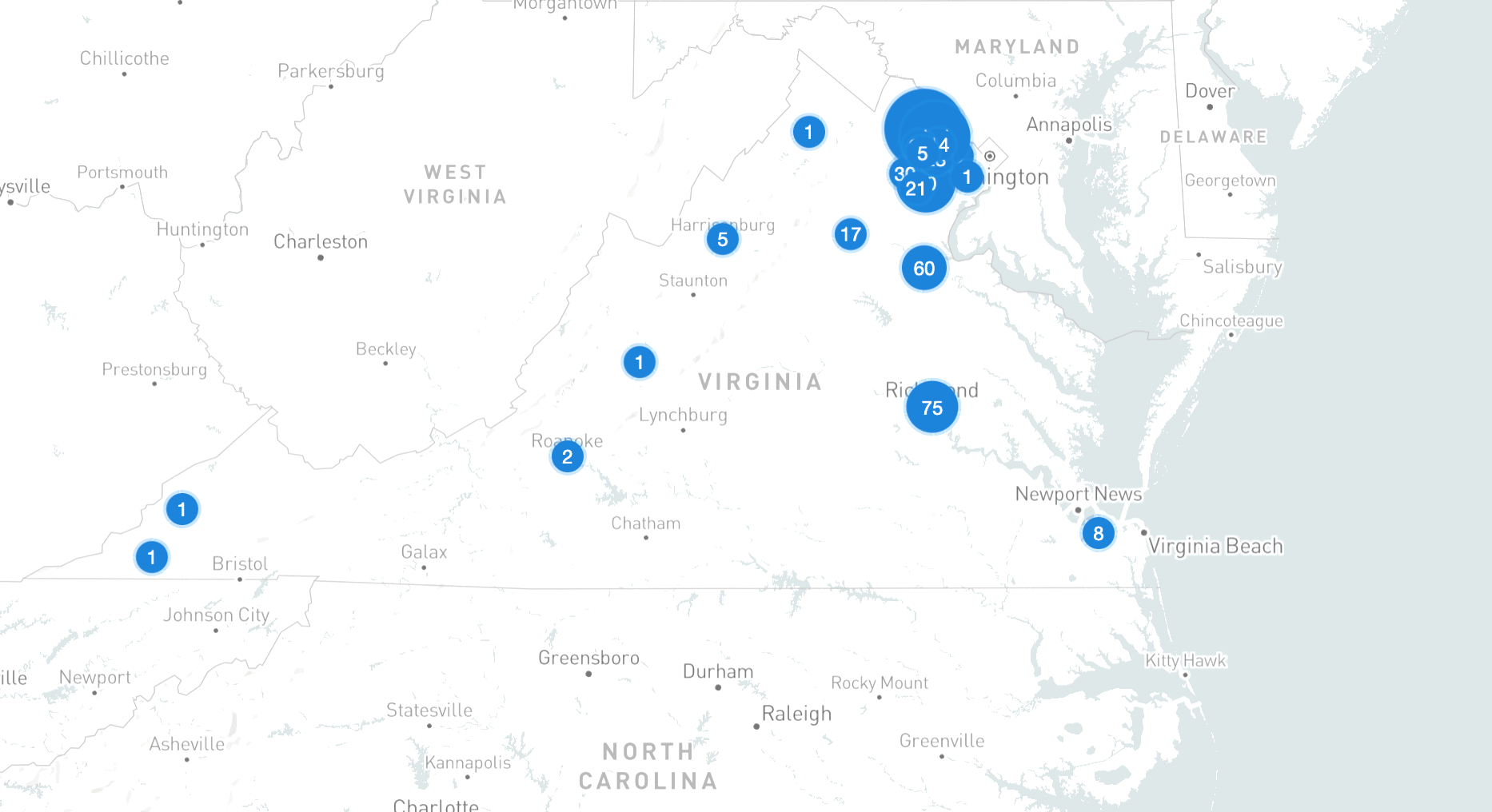

Take the 13-state Mid-Atlantic region supported by PJM Interconnection, a regional transmission organization that contracts each year for capacity power in its region.

For the 2024/2025 delivery year (June 1, 2024 to May 31, 2025), the price of power averaged out to $28.92/megawatt-day. For the following delivery year, that price jumped to $269.92/MW-day — a near 10x increase.

The reporting organization, the Institute for Energy Economics and Financial Analysis, attributes this increase to data centers.

“The 2022 forecast showed an increase in load of about 5,700 megawatts by 2037 in PJM’s Dominion Zone, which includes northern Virginia’s ‘data center alley,’” according to IEEFA. “In contrast, the 2025 forecast showed more than 20,000 MW of growth from data centers alone in the Dominion Zone by 2037.”

Related Article: AI's Voracious Appetite for Land, Water and Power Is Your Next Big Business Risk

Consumers Have Already Paid Billions — With More to Come

The result of this massive increase in energy demand? A $14.7 billion charge this summer for the 63 million people in the region, wrote the Natural Resources Defense Council, a national environmental advocacy group. “By comparison, in 2023 and 2024, this charge was $2.2 billion. Next summer, even more proposed data centers will raise it to $16.1 billion — a sevenfold increase in just two years.”

And that’s not all, the NRDC warned. It estimates that unless something changes, PJM consumers alone will pay another $163 billion through 2033 as new data centers exceed available power supply.

By 2028, the average family in the Mid-Atlantic region will pay around $70 more per month on their electricity bills due to forecasted data center growth.

Confidential Contracts Keep Consumers (and Regulators) in the Dark

In some states, data center companies have made deals with utility companies that aren’t even public, Ari Peskoe, director of the Electricity Law Initiative at Harvard Law School, told VKTR.

In Mississippi, incentives to attract data centers allowed the utility to sign a contract with Amazon that was not reviewable by utility regulators. “We have no idea what’s in it," said Peskoe. "Presumably when there’s a secret deal, there’s a reason you want to keep it secret.”

Another issue is that most utility companies are for-profit businesses, and they have an incentive to build data centers. “The utility business model is that they make money by building stuff,” Peskoe added. “They get a profit margin on building stuff. Data centers are a good excuse to build big stuff.”

Will Utility Companies Fight Back — or Fuel the Fire?

In some regions, utilities are taking steps to help protect consumers against price increases caused by data centers.

Idaho, which has some of the lowest electric prices in the nation, has started to attract hyperscale data centers — massive facilities that house the computing and storage systems needed to support large-scale cloud computing and AI workloads.

Meta announced one of these Idaho-based hyperscale data centers in 2022, scheduled to open in 2026. announced one in early 2025 but wouldn’t say for which company. Both are located in Kuna, a city of around 30,000 people about 20 miles from the state capital of Boise, a city that has worked to court data centers.

Idaho Power reportedly has policies in place to mitigate the rate impact large power users (like data centers) could have on rates for other customers.

“Large power users exceeding 20 MW must enter into an Energy Services Agreement with Idaho Power, including cost-based rates and other customer protection provisions that must be reviewed and approved by the Idaho Public Utilities Commission in an open and public process," said Jordan Rodriguez, a spokesman for the power company.

While some utilities are taking steps to protect residential customers, those same companies have seen pushback from data center operators, saying they're being singled out.

When the Bill Is Due Before the Lights Are On

A separate rate class doesn’t necessarily help if a data center takes years to open — or ends up not opening at all, said Peskoe. That’s because utilities had to pay the upfront costs of expanding their infrastructure, such as transmission and substations, to support the data center. And if it never opens, consumers are on the hook for those costs.

“What we’re seeing is that the class is required to enter into long-term contracts, and that protects ratepayers from the risk that the utility invests in infrastructure and the data center doesn’t become operational,” explained Peskoe. “The owner would still have to pay some significant amount to the utility to protect against the possibility that the utility would seek funds from other ratepayers.”

Idaho Power is also taking steps to mitigate those other costs for consumers. “Under a ‘growth pays for growth’ framework, large power users are also required to pay upfront for any interconnection costs (transmission, distribution and/or substation upgrades) necessary to connect their project to the grid, ensuring these costs are not shifted to other Idaho Power customers,” Rodriguez said.

Diode noted about its data center project: “As all large-load projects in Idaho are required, Gemstone Technology Park will assume responsibility for 100% of the costs solely associated with any upgrades required to interconnect the project to Idaho Power's system.”

Related Article: Why AI Data Centers Are Turning to Nuclear Power

Some States Push Back Against AI Power Costs

In some states, legislators are passing laws intended to keep consumers from bearing the brunt of costs brought on by data center expansion. These laws may be one of several types, Peskoe said.

In Texas, for example, which has been plagued by weather-related blackouts, the state is potentially requiring industrial computing facilities to shut off if there’s a shortage of electricity in the system and require facilities to have backup power.

Utah allows facilities to generate their own power and even to go completely off-grid, which is not allowed in many states, Peskoe explained. You have to get a license to be a utility, he continued, but such a law creates legal complexity because it gives data center operators the ability to contract with a power plant developer without being regulated as a public utility.

Idaho also allows data centers to set up their own generation facilities — Meta is planning a 200-MW renewable energy facility on its site.

The NRDC also supports such efforts, particularly in regions such as PJM's Mid-Atlantic. “New data centers and other large loads would only receive service on an ‘as-available’ basis until they add enough supply (or reduce demand or add storage) to the grid to support themselves,” the organization proposed. “Doing so would lower costs through 2032 by about $100 billion.”

Other data center power laws passed this year included:

- A new Oregon law (House Bill 3546) requires the Oregon Public Utility Commission (PUC) to create a separate service classification for large energy use facilities, designed to ensure high-demand users cover their own costs rather than shift them elsewhere.

- Ohio public utility regulators also created a separate service classification, along with requiring data centers to pay 85% of the power plant capacity they sign up to use, even if they end up using less.

- An existing California law allows state regulators to fix the rates and charges for every public utility, and requires those fees to be just and reasonable. In addition, a new law (SB 57) will require utilities to submit assessments on the extent to which utility company costs associated with data centers result in cost shifts to other customers.

Federal Oversight May Be the Missing Link

Not all electricity costs can be handled on a state level. Organizations like the PJM and its equivalents in other regions are governed by the Federal Energy Regulatory Commission (FERC).

“States can’t do this alone,” Peskoe said. “FERC has been slow to take this up and Congress hasn’t passed any laws. We need coordinated action.” But is that going to happen under the current administration? “I’m not going to try to predict that,” he said. “But electricity costs are a big political issue.”